Reinsurers’ Net-Zero activities lead to transition risks and reinsurance gap

While most discussion around climate change and reinsurance is focused on its role in providing coverage for physical risks, reinsurance can also have an impact from a transition risk perspective. Authors Christoph Mohr, Jeffery Yong and Manuela Zweimueller, elaborate on reinsurers’ activities in addressing climate challenges as well as the risks arising from moving to Net-Zero.

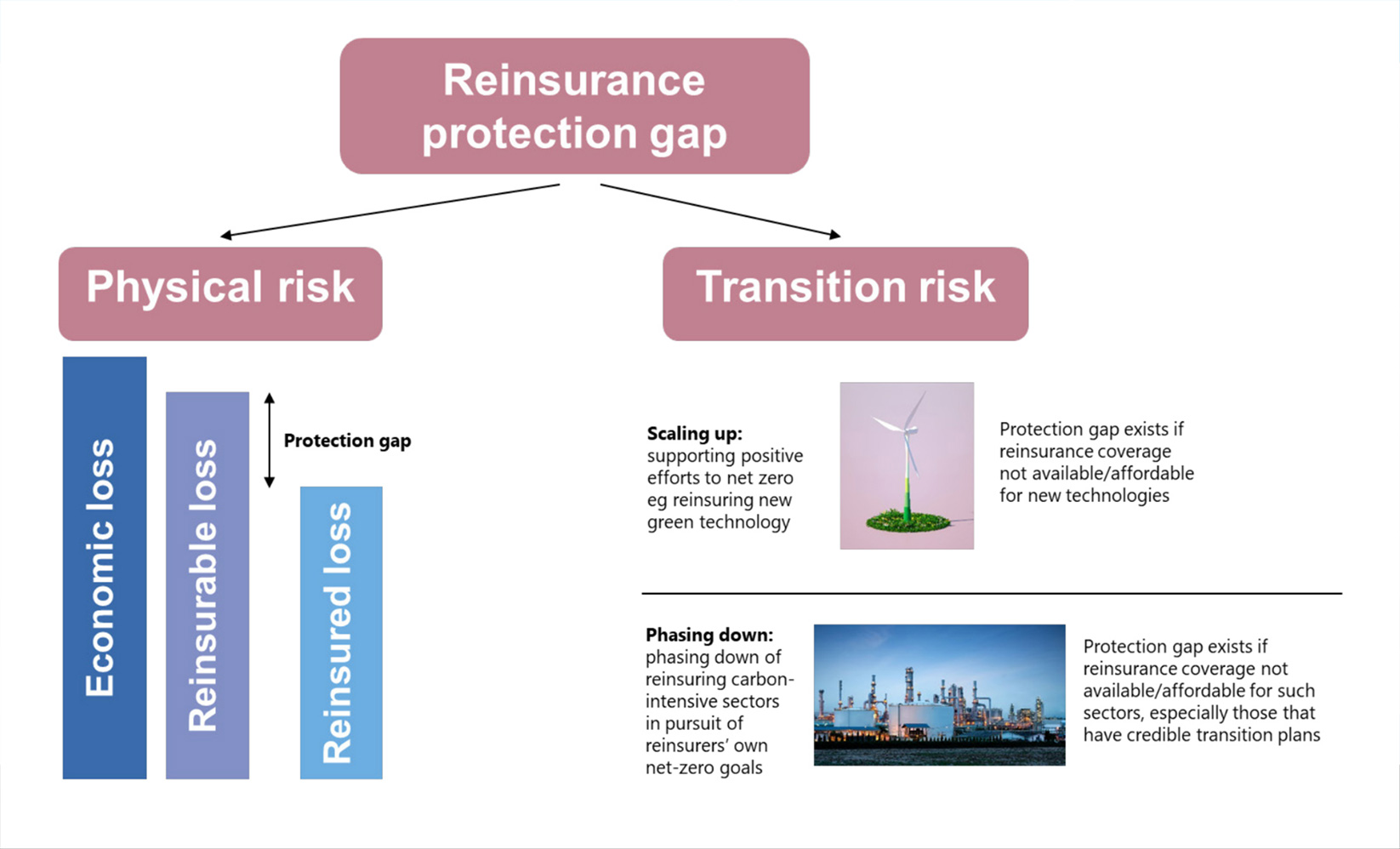

Components of the reinsurance protection gap

Source: authors’ elaboration

From a pricing and underwriting perspective, reinsurers pursue their Net-Zero goals in various ways, including by providing coverage for new green technologies (“scaling up”) and/or limiting coverage for carbon-intensive sectors (“phasing down”). The approaches—scaling up and phasing down—may result in what is described as transition risk, leading to broader economic and financial stability implications.

Green technologies

Reinsurance can contribute to “scaling up” green technologies that enable the reduction of greenhouse gas emissions. Scaling up involves reinsurers actively facilitating the growth of sustainable technologies and renewable energy projects by offering reinsurance coverage solutions to address the unique risks associated with these innovations.

Reinsurers may, through their underwriting, provide cover across the value chain for products or services that support climate risk mitigation. These include renewable energy such as photovoltaic installations, heat pumps and wind farms, as well as rail systems, greener buildings, environmental restoration, carbon sequestration and carbon credits.

For renewable energy, for example, reinsurance might cover the risks associated with the construction (engineering), operations (property) and performance (financial losses) of solar or wind parks, including damage from physical risk. It is estimated that insurance cover may be required for $10tn of investment in financing the climate transition through to 2030. Reinsurers could be considered “transition enablers”.

Reinsurers may have commercial interests in reinsuring new technologies or supporting their development through their risk management expertise. This could be a forward-looking move for access to alternative sources of business in the future to compensate for the loss of existing business such as carbon-intensive sectors/assets that may disappear due to transition efforts.

In terms of supporting new technologies, Lloyd’s of London has traditionally been a global reinsurance marketplace that enables the underwriting of new risks. It continues to provide reinsurance for new green technologies. Other large (re)insurance players are also exploring innovations and providing cover for green technologies. Transition to net zero may therefore play a role in their longer-term business strategy.

Pricing of reinsurance coverage

The pricing approaches that support the scaling up of transition activities may need to be adjusted due to the lack of historical data. Assessing and pricing risks associated with new technologies and activities can be more uncertain, especially given limited loss experience. Some direct insurers may thus not currently be inclined to write much of this business or may reinsure out most of the risks. Alternative approaches may be used to price new innovative scaling up of reinsurance products.

For example, Lloyd’s of London is considering using environmental, social and governance (ESG) ratings when pricing insurance products.

Another pricing approach is to find existing products with similar features and use these as proxies. Through trial and error in a controlled fashion (eg limiting the volume of business), pricing can improve over time as loss experience emerges. Some reinsurers may allocate a certain portion of their underwriting volume to such risks to gain insights and expertise (eg through their risk engineers). For reinsurance covering green technologies, a good understanding of the manufacturers, production processes and products can help reinsurers to price appropriately.

Limiting coverage

Some reinsurers may seek to limit coverage for carbon-intensive sectors with a view to pursuing their own Net Zero transition goals. Where it occurs, this involves a strategic and gradual reduction in underwriting certain sectors that are heavily reliant on fossil fuels and other carbon-intensive activities.

Such underwriting policies may not necessarily be driven by perceived or evidenced higher insured risks. On a voluntary basis, some large insurers and reinsurers have committed, eg in their transition plans, to transition to net zero and publish their efforts. The commitment could involve slowing down or stopping (new) reinsurance coverage for certain carbon-intensive sectors.

It is critical that the reduction in reinsurance capacity in carbon-intensive sectors, where it occurs, is done in a thoughtful way. An abrupt and indiscriminate withdrawal could lead to economic disruptions with potential financial stability implications. Some reinsurers may provide continued reinsurance of these sectors, gradually phasing them down on the basis that their underwriting approach has an effect on how these industries reduce their carbon impact.

Reinsurers can also support insurers’ efforts by sharing knowledge. This is, for example, also promoted by the United Nations-led and convened Forum for Insurance Transition to Net Zero (FIT). Engaging with counterparties to support them in transitioning to a lower carbon footprint may be deemed more desirable than withdrawing reinsurance coverage to such entities.

For example, while Japan’s Stewardship Code does not explicitly refer to the transition to net zero, it fosters the principle of engagement and dialogue with investee companies, ie clients, with regard to sustainability, including ESG factors.

Emerging markets

The underwriting policy of some global reinsurers to phase down coverage of carbon-intensive sectors may also have unintended consequences for emerging markets and developing economies (EMDEs).

In practice, it seems that such reductions are primarily being undertaken by reinsurers based in the European Union due to the European Commission’s commitments to reduce greenhouse gas emissions to zero by 2050.

As primary insurers, especially in EMDEs, may rely on reinsurance capacity based in the EU to support their vital (yet potentially carbon-intensive) economic sectors, reinsurance withdrawal can have wide-ranging economic impacts in these jurisdictions.

Reinsurers’ policies, that are set by the groups’ headquarters based in advanced jurisdictions can leave a reinsurance protection gap open in EMDEs. Such gaps may ultimately need to be covered by governments in those jurisdictions. Other players, including captive reinsurers, may enter the market and address the gap to a certain extent.

This commentary was first published in a section of the FSI Insights paper titled “Mind the climate-related protection gap–reinsurance pricing and underwriting considerations”, released by the Financial Stability Institute (FSI) of the Bank for International Settlements (BIS) and the International Association of Insurance Supervisors (IAIS). FSI Insights are written by FSI members often in collaboration with staff from supervisory agencies and central banks. The views expressed in this paper are solely those of the authors. Free access to the paper is available on the BIS website (www.bis.org).